Cod3x is the most advanced AiFi platform on the market.

It currently services thousands of AI agents completing actions on behalf of users on the blockchain fully autonomously.

In this tutorial, you will learn how to create and set up an Agent on Cod3x with an advanced trading strategy.

This step by step tutorial will guide you through the optimized creation process. There may be other ways to set up an agent, but I have found the following process to be the most efficient.

Before beginning lets get this out of the way.

Disclaimer: The information provided in this article is for educational and informational purposes only. It does not constitute financial, investment, legal, or tax advice. Trading and using autonomous financial agents involve risk, and past performance is not indicative of future results. You are solely responsible for your own investment decisions, and you should consult with a licensed financial professional before acting on any information contained here. The author assumes no liability for any losses or damages resulting from the use of the strategies or tools discussed.

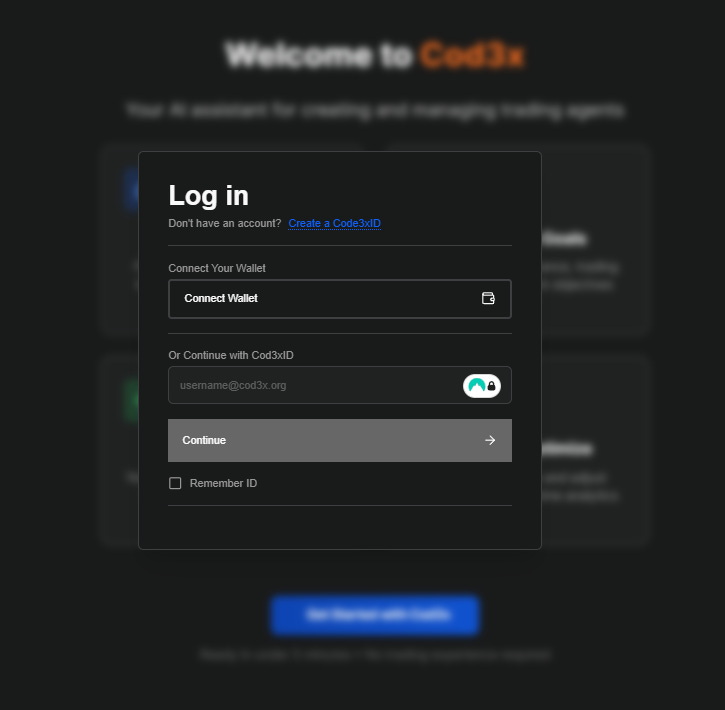

Logging In

When you first navigate to the trading terminal on the Cod3x trading terminal website you will be greeted with an account login prompt.

At this point you should ignore the Cod3xID login.

I have found the social login aspect to be buggy, with the Connect Wallet option to be more reliable.

Agent Creation

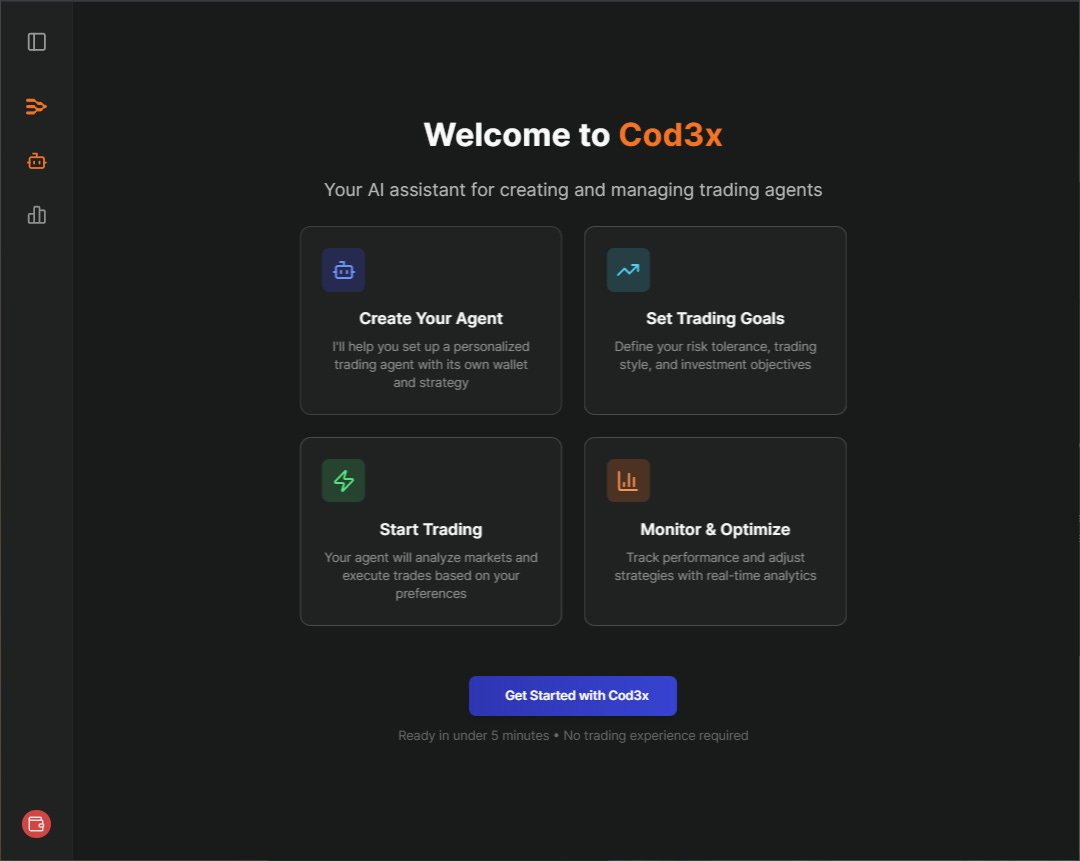

After connecting your wallet, and signing the login transaction, you will find yourself at the Cod3x trading terminal landing page.

At this point we will get started, it is important to follow the steps I have outlined below in order to reduce bloat in your agent.

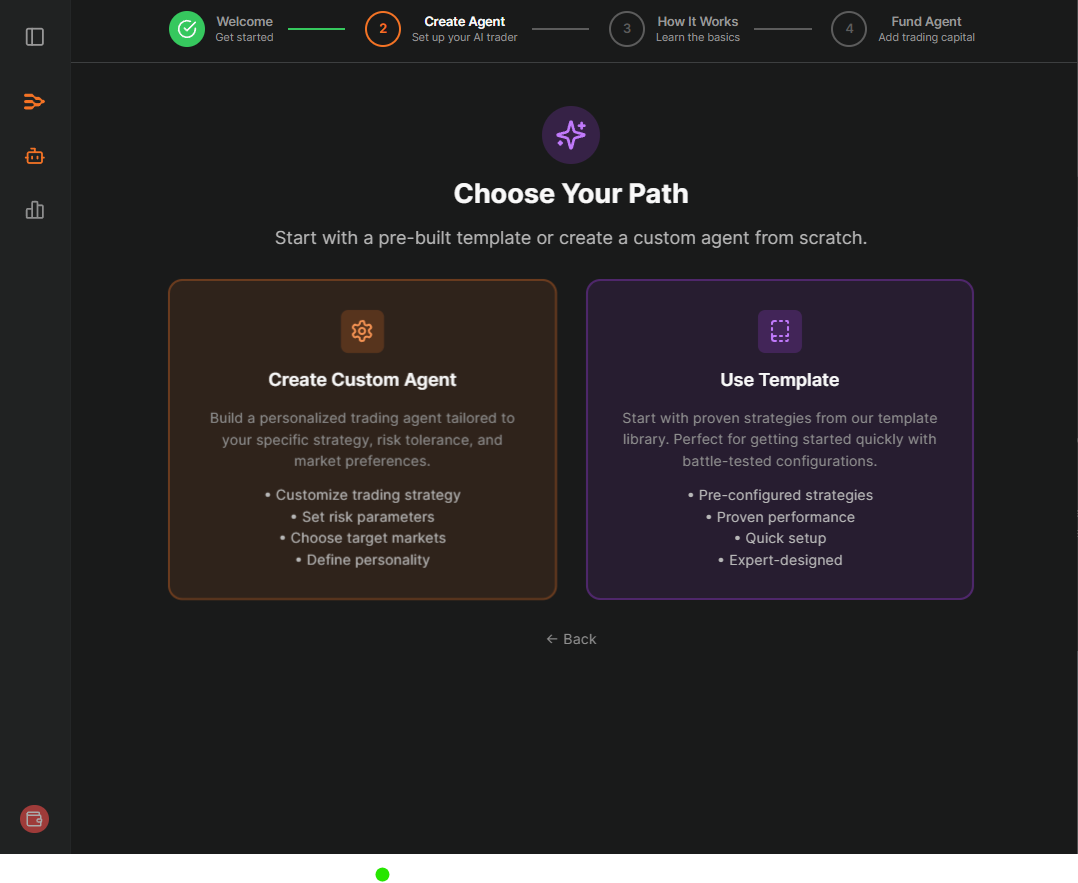

We can see that when choosing our path for creation, we have two options.

We can either “Create Custom Agent”, the one we will be using in this setup, or we can “Use Template”.

At the point of writing this article, the templates have not been flushed out or performing as well as Cod3x intended them to with the new trading terminal.

For the sake of time we will use “Create Custom Agent” and leave a majority of settings empty to be filled in manually.

There will be 4 steps to setting up an agent.

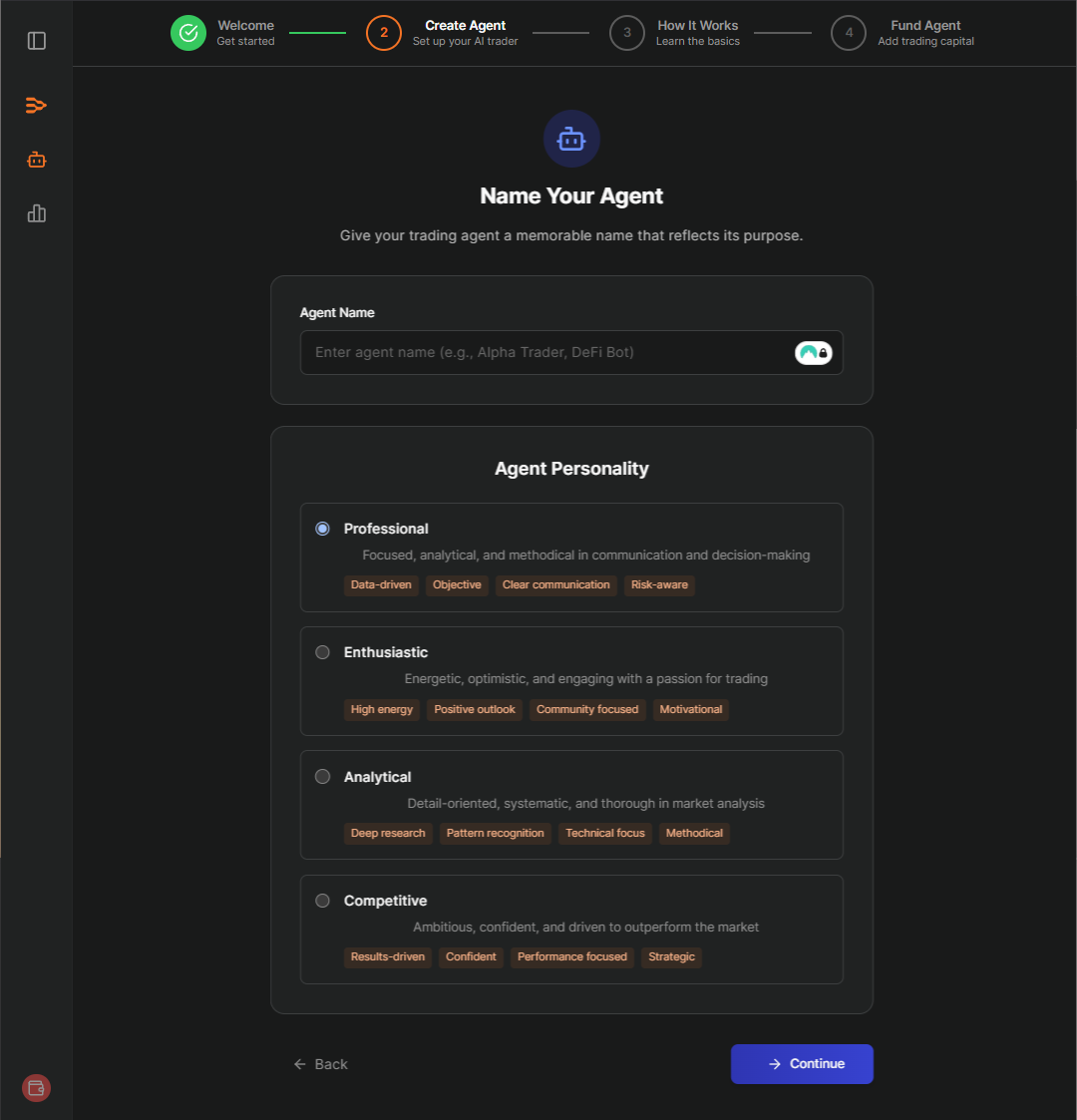

1. Agent name and personality

On this page we will set the agents name and personality type which can affect its responses and general personality.

First, you can give your agent a name.

No two agents in your terminal can have the same name, although you can create multiple agents, the names of your agents need to be unique in your own account.

For agent personality I recommend “Professional”.

A “Professional” approach allows for systematic analysis while keeping the agent glued to the analytics that it performs well with.

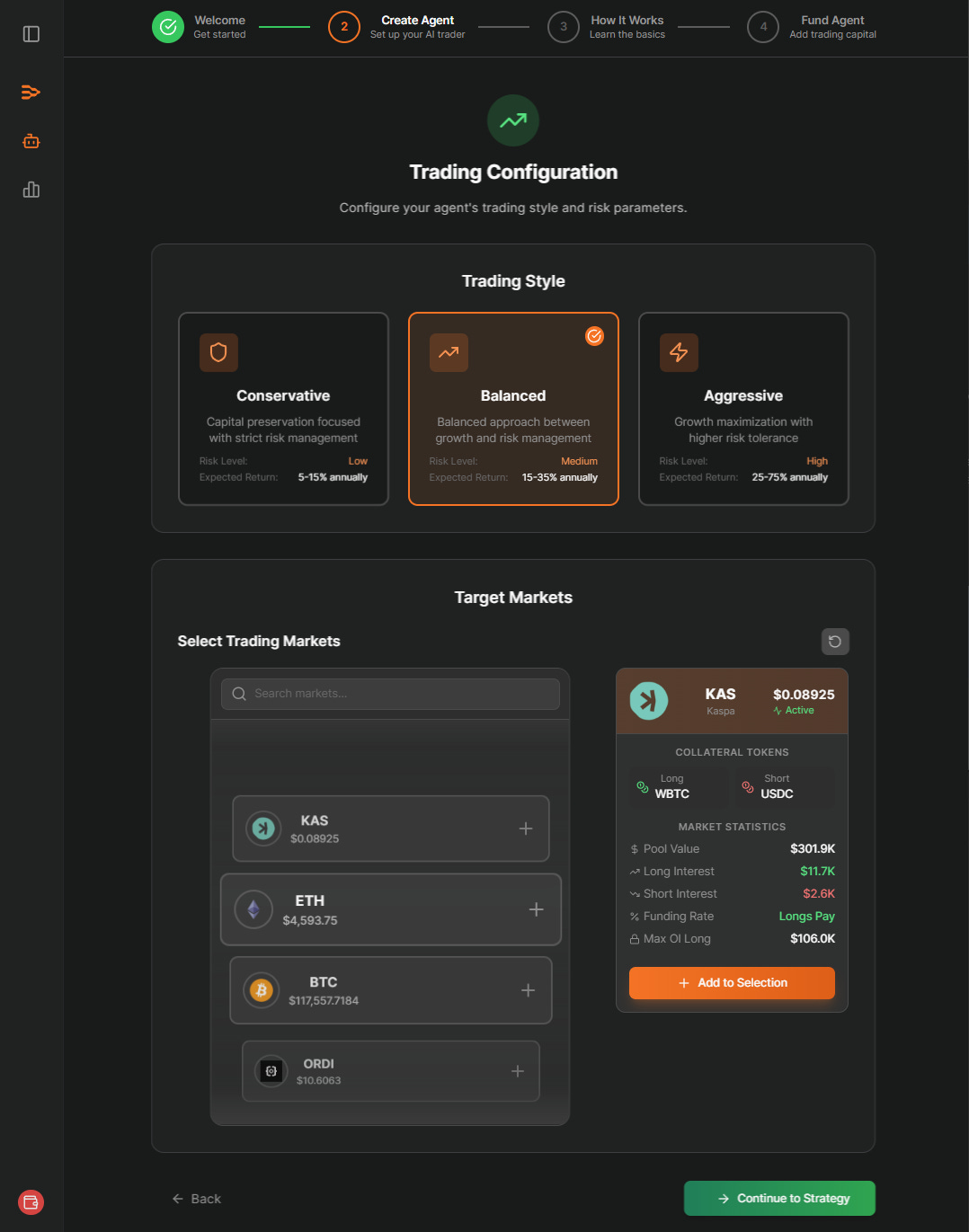

2. Trading Configuration

This page we will leave mostly blank and leave the “Trading Style” as the default balanced

Leaving the “Trading Style” as balanced allows us to influence our agent more heavily with the “Trading Strategy” we will be setting later.

We will also leave the “Target Markets” section empty.

The tokens you select in this section have no influence on what you can trade once your agent is created.

If you do select any tokens here, they will only populate in your “Trading Strategy” which we will be altering after creation so it will be removed anyway.

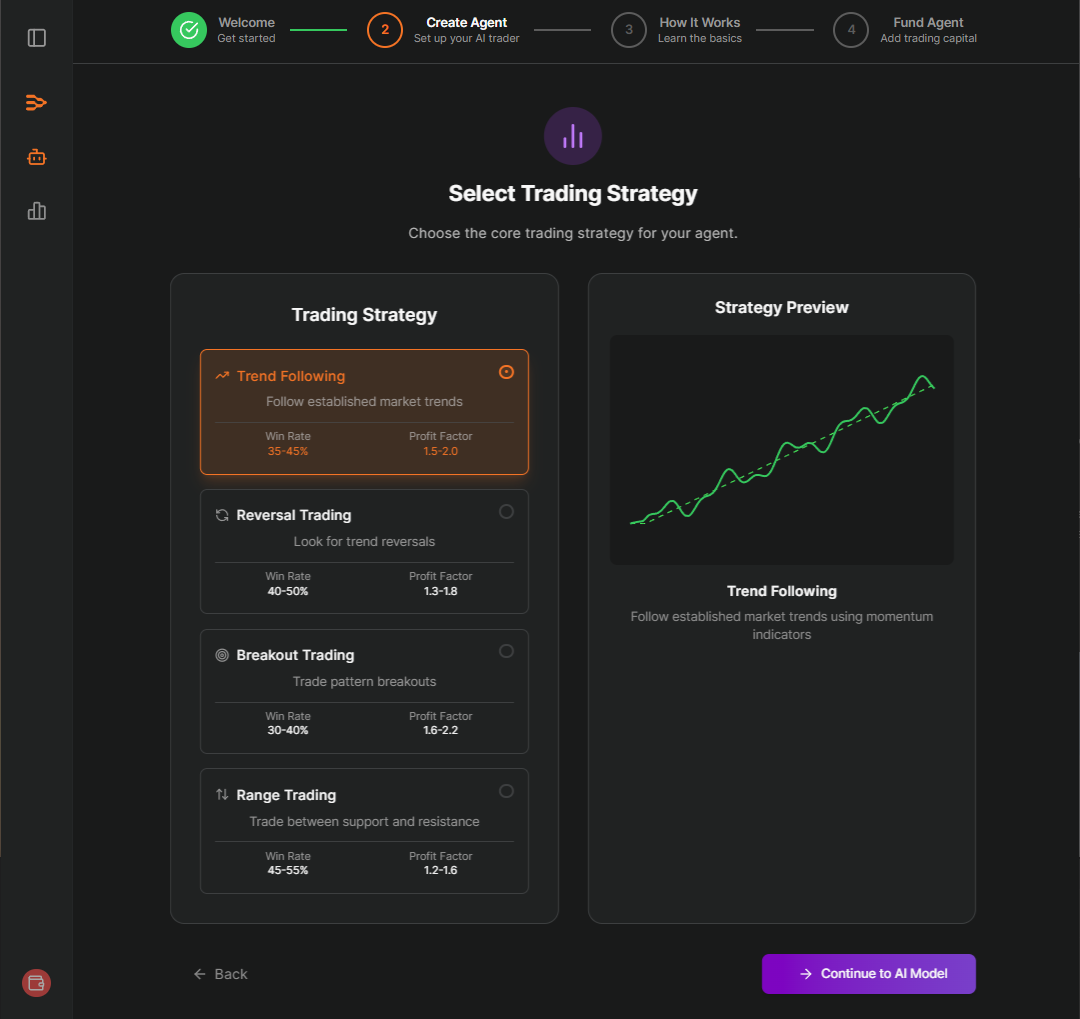

3. Trading Strategy

This page will ask you to select a “Trading Strategy” from a predefined set.

Given we will be altering the “Trading Strategy” completely and removing anything generated by the system we will opt for the default “Trend Following”.

Do not worry if you select something else in this section as we will be removing any text related to the auto-generated “Trading Strategy” coming from Cod3x.

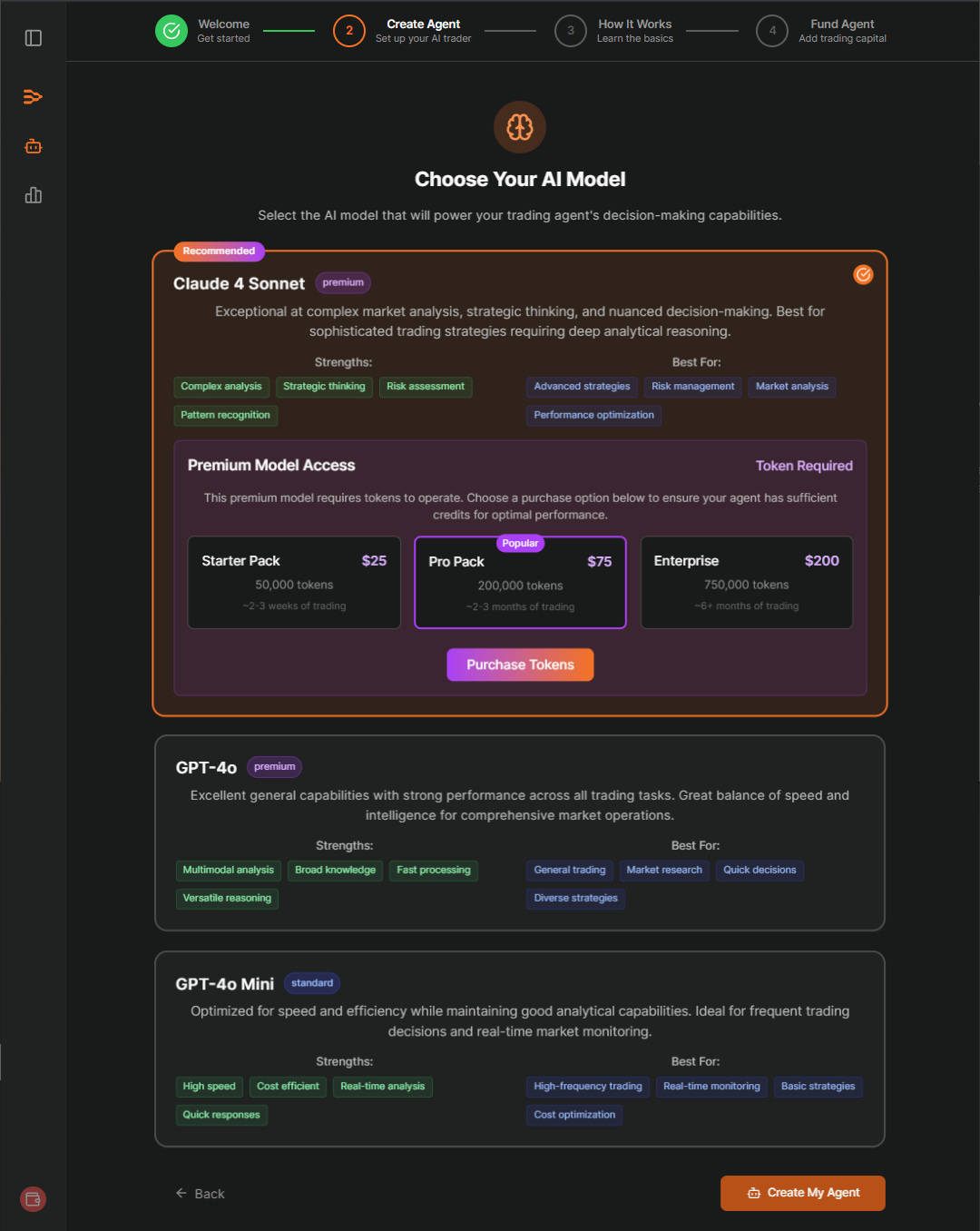

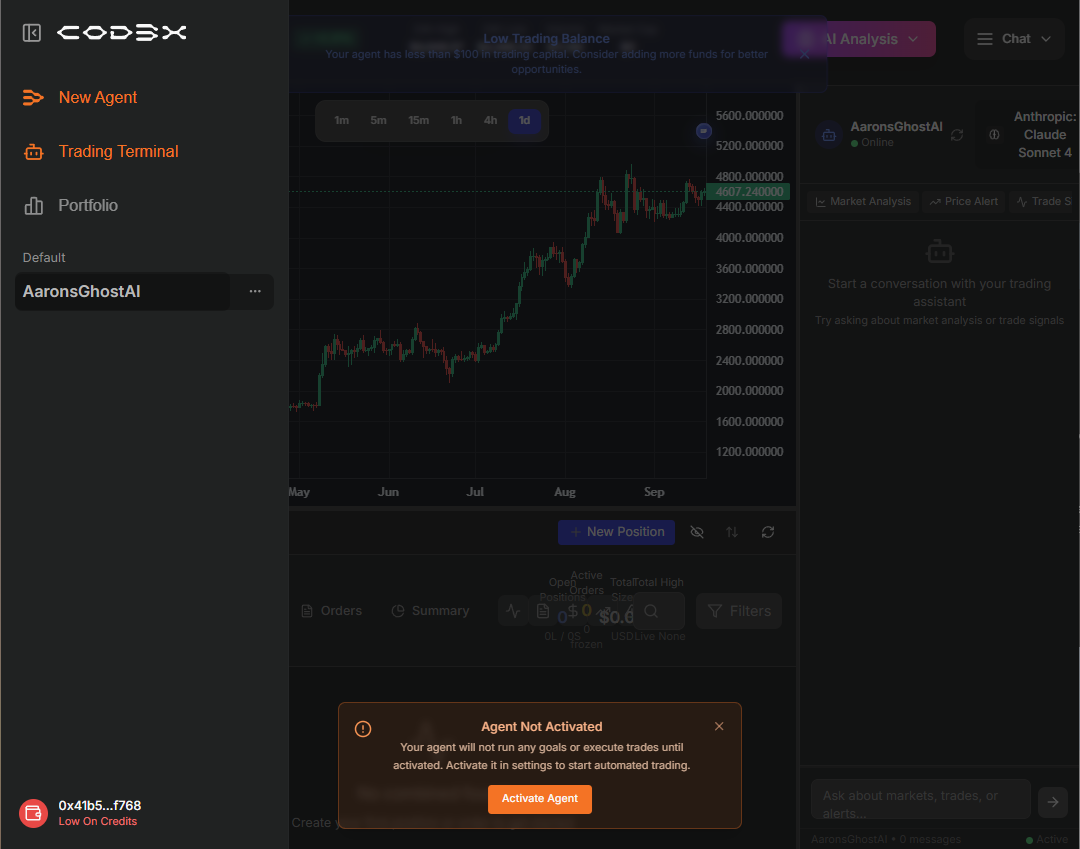

4. Model Selection

This page will decide the default model your agent uses for interaction in the chat.

Do not worry about the “Purchase Tokens” button yet.

Ignore that, as we can add credits directly to our wallet later.

At the time of writing this article, I recommend Claude 4 Sonnet for its ability to use the tools Cod3x has created as well as its superior financial analysis capabilities compared to ChatGPT.

Although ChatGPT can be more efficient, consume fewer credits, and act better in certain circumstances, Claude has been unlocked to provide better financial analysis out of the box compared to current ChatGPT models.

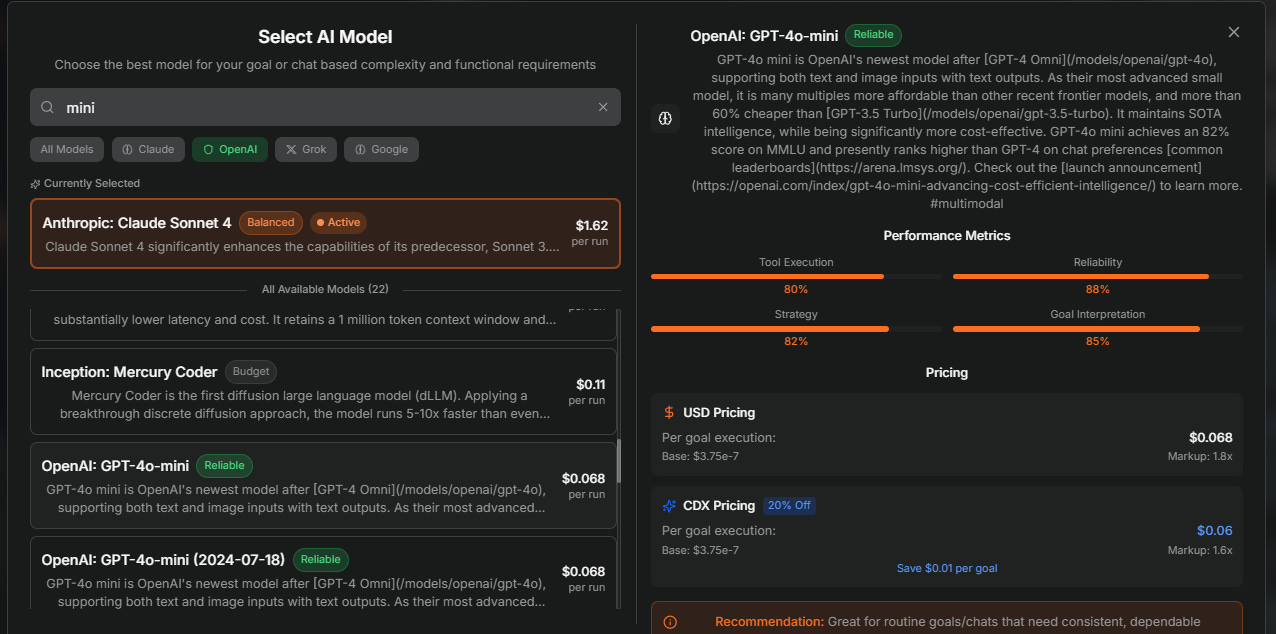

Side not regarding model cost:

Price between models can vary drastically.

Each AI provider has multiple models, each with different complexity that consume different amount’s of “Cod3x Credits”. Depending on the complexity of the model, it will cost you more or less credits to interact with it. While a model like ChatGPT 4o Mini can be cost effective its ability to not hallucinate, interact with tools, and analyze financial data is far less than a model like Claude Sonnet 4

Choosing when, and where to use a model is almost as important as the prompts and chats you create. Be sure to verify that you are always using the correct model for the outcome you wish to achieve.

5. Navigating to your newly created agent

After creating your agent you may not be routed to it right away

In this case, you need to expand the side navigation by clicking the first icon in the side navigation

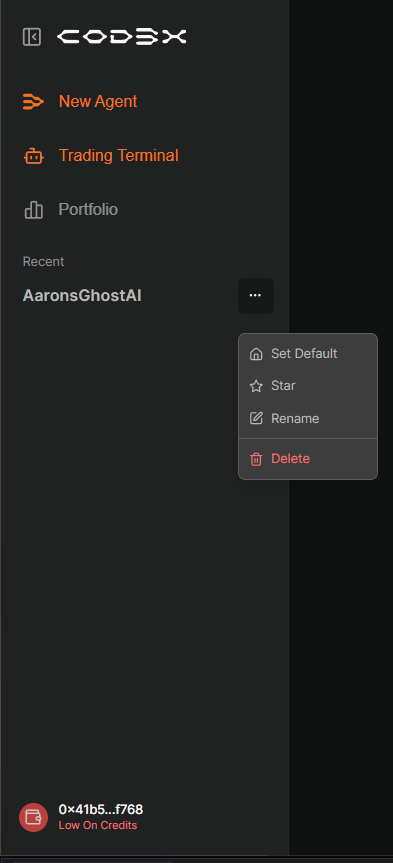

After expanding the navigation, you can see your newly created agent in the list of “Recent” agents.

If it does not show up right away, you may need to hard refresh the page with “CTRL + SHIFT + R” on Windows or “COMMAND + SHIFT + R” on Mac.

Hover over the newly created agent and select the 3 dots to expand settings related to your agent.

You will want to “Set Default” your new agent.

You can also choose to “Star”, “Rename” or “Delete” an agent from these settings.

WARNING! If you “Delete” an agent, any wallets associated will be LOST WITHOUT ANY POSSIBLE RECOVERY OF FUNDS.

After setting your agent to default, navigate to your agent by click on it under the “Default” list.

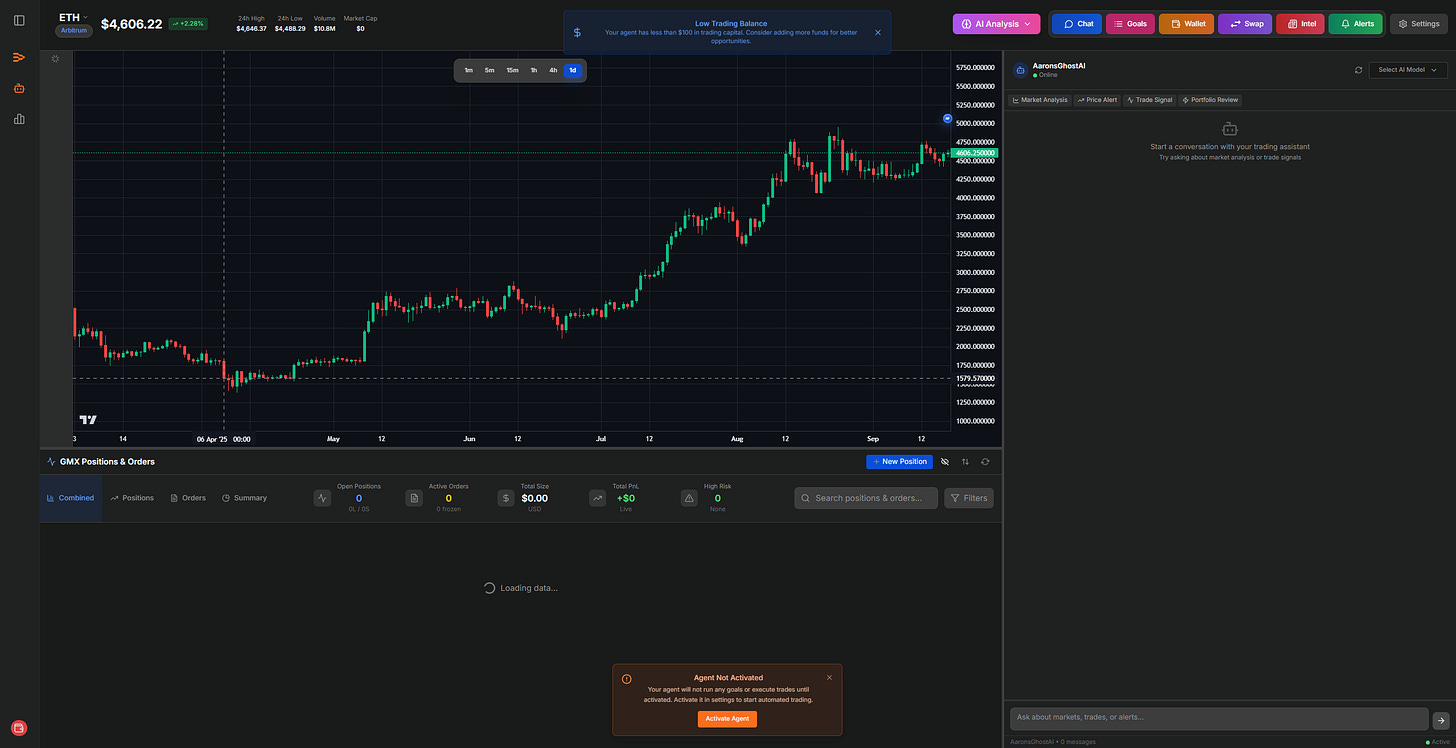

You can now close your side nav and view the Trading terminal created by Cod3x

There will be follow up articles to go over the intricacies of the whole trading terminal.

At this time, we want to focus on optimizing the setup and “Trading Strategy”

Trading Strategy Basics:

In order to optimize our “Trading Strategy” we need to understand how the trading strategy is used by the Cod3x agents.

Each time you “Chat” or run a “Goal” associated with your agent the “Trading Strategy” will be injected into the chat for you.

This means the AI model will read your “Trading Strategy” before looking at your “Chat” message or “Goal Description” to better understand what you are looking for in the response as well as what tools may assist in the response as it relates to your trading strategy.

For example, if you say in your trading strategy “Every time you look at a coin on GMX, make sure to view the chart on the 1hr and 4hr time frame” then proceed to chat with the agent send a message like “Examine $DOGE” the AI will have both the “Trading Strategy” and chat message before it starts working.

The AI responding will see something like

Trading Strategy: Every time you look at a coin on GMX, make sure to view the chart on the 1hr and 4hr time frame

User Message: Examine $DOGEWithout a specific strategy, the agent may guess at what time frames to look at or may not use any tools at all and opt for hallucinating price without calling the tools Cod3x has built to help the agents.

By adding details to our “Trading Strategy” we are giving the AI (Claude Sonnet 4) context on how we want to trade, in the case above we always want to check the 1hr and 4hr charts when examining a coin.

We can also see from this example that each word and text character we add to our trading strategy will eat into our “Credits”.

Since AI uses “Credits” for each character sent in a message, if we can reduce message size, we can decrease the amount of credits used by the AI when reading the message. This will come in handy later when the AI is utilizing larger context in complex chat messages or goals that can eat into your “Credit” count.

This is a simple example but shows how the “Trading Strategy” can be used in powerful ways given it is sent before every user message or goal execution.

Creating a Trading Strategy:

Now that we understand the basics of how a trading strategy is used by Cod3x, we can go ahead and develop our own.

Some things to remember during this process:

Formatting matters:

Given your “Trading Strategy” is being fed to an AI we can optimize its performance through Markdown syntax and formatting. Instead of vomiting text into the “Trading Strategy” we can use Markdown to format sections, ideas, and similar statements to reduce word count and increase efficiency.

Size matters:

Agents context windows are different per model. Some agents have a large context window and can read a lot of text before “Losing memory” about what was said earlier in the chat message. Reducing the “Trading Strategy” size can help the agent remain focused while reducing credit usage. The more concise we can be in the “Trading Strategy”, the better the agent will be able to interpret all the context while remaining focused.

Output matters:

When the agent responds in the chat we want the output to be formatted in such a way that the answers are consistent, concise, and provide actionable context for any follow up messages. I have found that Markdown provides great ways to format text output, while JSON is a great way for the agents to pass precise context to the next chat message.

For Example, instead of asking an agent to give you a long position to open on $DOGE we would rather ask the agent to provide a long position on $DOGE with a market summary in Markdown and precise entry, stop loss, take profit, indicators, and conviction logged in a JSON.

“Give me a long position to open on $DOGE”

It looks like there is a good position on $DOGE with a 0.26 entry and a take profit of 0.305 with a risk managed stop loss of 0.265. Given I have high conviction in this trade with current prices oversold, a distribution recovery, and a successful breakout above critical resistance; would you like me to execute it now?“Provide a Long position on $DOGE with a market summary in Markdown and precise entry, stop loss, take profit, indicators, and conviction logged in a JSON”

DOGE (Dogecoin)

4H Timeframe

Indicators Observed: • Price Action: $0.2814 above both SMA20 ($0.271) and SMA50 ($0.269) with strongly rising SMA50 • Momentum: RSI at 60.94 - healthy pullback from extreme overbought levels (87.43) • Volume: OBV strongly rising (7.8M) confirming accumulation pattern • Pattern: Bull flag formation after explosive +31.89% rally

1H Timeframe

Indicators Observed: • Price Action: $0.2814 above SMA20 ($0.278) with price near resistance • Momentum: RSI at 60.79 recovering from oversold conditions • Volume: OBV recovering from distribution to accumulation (-2.3M) • Pattern: Successful breakout above critical resistance levels

Conviction Level: HIGH Possible Position: GO LONG (20-30x leverage, 5-10% margin allocation)

Rationale: Meets 4/4 strategy confluence requirements - trend above SMAs, RSI >50 and rising, volume >30d average with OBV accumulation, and bull flag breakout pattern. Clear stop at $0.265, targets $0.31-$0.32.

{

"individual_analysis": [

{

"coin": "DOGE",

"indicators": ["RSI 60.94", "Bull flag pattern", "Strong OBV", "4/4 confluence"],

"conviction": "High",

"position": "Go Long",

"entry_zone": "$0.275-$0.280",

"stop_loss": "$0.265",

"targets": ["$0.31", "$0.32"]

},

]

}As you can see, the second message is a lot more descriptive and easy to read.

With the JSON output we can clearly see the entry, stop loss, targets and conviction related to the trade. This makes it easier to manually open a trade, or provide the simple JSON output in our next message as clear instructions for a trade to be opened.

Creating the strategy with AI assistance:

Now that you know the basics of how to create a strategy, let’s work with ChatGPT or other AI model to create an optimized strategy.

You can opt to work through this process or scroll to the end for a drop in “copy and paste” solution.